SBP Remittances for Non-Resident Directors Get Regulatory Ease

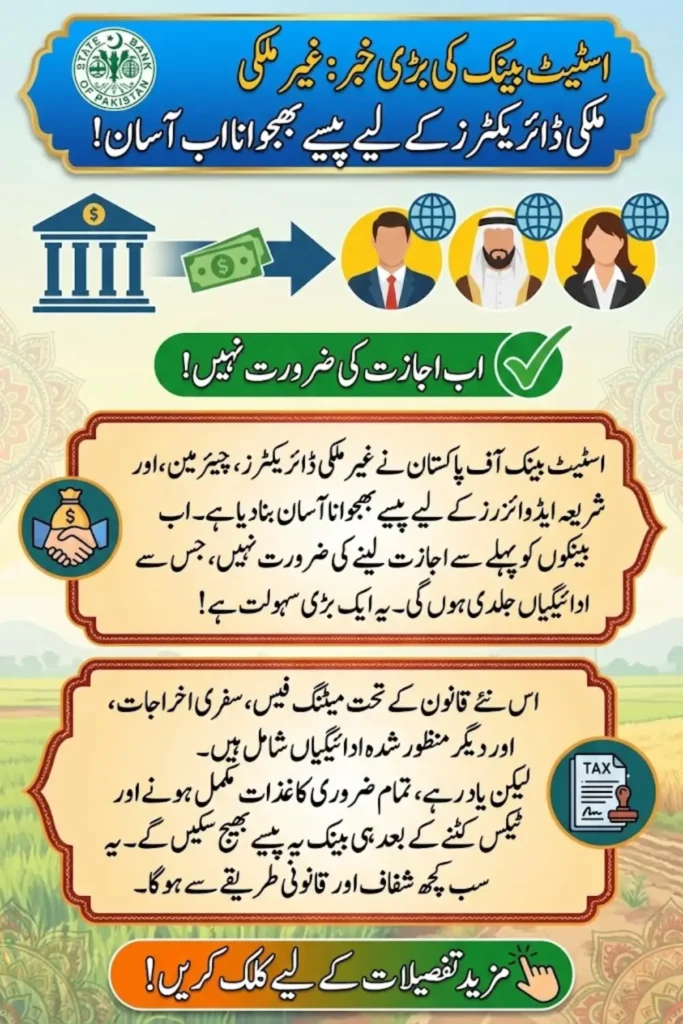

The SBP has introduced a facilitative measure allowing banks and financial institutions to process remittances for non-resident directors, chairmen, Shariah advisors, and Shariah scholars without seeking prior approval. This step is aimed at streamlining routine financial transactions while maintaining regulatory oversight through documentation and due diligence.

Under the new instructions, authorized dealers can process these payments once all required documents are completed and verified. The move reduces administrative delays and ensures timely compensation for non-resident individuals serving regulated entities in Pakistan.

- Prior SBP approval no longer required

- Applicable to banks and other regulated financial institutions

- Remittances allowed subject to complete documentation

Categories Covered Under SBP Remittances for Non-Resident Directors

The SBP circular clearly defines the individuals eligible under this facilitation. It applies to non-resident directors and chairmen serving on boards of regulated entities, as well as Shariah advisors and Shariah scholars associated with Shariah boards.

SBP Remittances for Non-Resident Directors – 2026

SBP allows banks to send payments without prior approval

Eligibility

Non-resident directors & Shariah advisors

Payments

Meeting fees, TA/DA & board-approved remuneration

Requirements

Complete documents & due diligence

Processing

Banks can remit without SBP approval

Documentation

Tax proof & board resolutions required

Verification

Appointments & entitlement must be verified

Quick Actions / Key Points

- Banks process payments after documentation

- Tax deduction proof mandatory

- Remittances allowed in PKR

- Additional documents may be requested

These individuals often participate in governance and advisory roles from outside Pakistan. The revised approach recognizes their contribution and provides a standardized mechanism for processing remuneration in compliance with existing regulations.

- Non-resident directors and chairmen

- Shariah advisors and Shariah scholars

- Members of boards and Shariah boards

Types of Remuneration Allowed for Remittance

SBP remittances for non-resident directors may include various forms of compensation as approved by the board of the regulated entity. These payments must strictly follow the remuneration policy or board resolution already in place.

The circular allows flexibility in the nature of payments, provided they are properly documented and denominated in Pakistani rupees. This ensures transparency and alignment with corporate governance standards.

- Meeting fees and retainers

- Travelling and daily allowances (TA/DA)

- Other board-approved payments

Due Diligence Requirements for Banks

Before processing SBP remittances for non-resident directors, banks are required to carry out thorough due diligence. This ensures that payments comply with SBP’s instructions related to remuneration and governance.

Financial institutions must verify the authenticity of appointments, payment entitlements, and supporting documents. Proper record-keeping remains a core responsibility of authorized dealers under the revised framework.

- Verification of appointment approvals

- Compliance with board-approved remuneration policies

- Maintenance of complete transaction records

Mandatory Documentation for SBP Remittances

Banks must keep specific documents on record before effecting any remittance. These documents establish the legitimacy of the payment and confirm regulatory compliance.

The requirement ensures transparency and protects both banks and regulated entities from compliance risks while processing payments to non-resident board members and advisors.

| Required Document | Purpose |

|---|---|

| SBP approval or FPT clearance | Confirms valid appointment |

| Board-approved remuneration policy | Verifies payment entitlement |

| Meeting attendance confirmation | Supports meeting-based fees |

| Travel documents | Validates TA/DA claims |

Tax Compliance and Regulatory Forms

All applicable taxes must be deducted before SBP remittances for non-resident directors are processed. Proof of tax deduction is mandatory and must be retained by the authorized dealer.

In addition, all required regulatory forms must be duly filled and submitted. This step ensures that remittances remain compliant with Pakistan’s tax and foreign exchange regulations.

- Proof of tax deduction required

- Submission of prescribed forms

- Compliance with foreign exchange rules

Discretionary Authority of Authorized Dealers

The SBP has also empowered authorized dealers to request any additional documentation they consider necessary. This flexibility allows banks to manage risk and address transaction-specific requirements.

By granting this discretion, the SBP ensures that while procedures are simplified, regulatory control and accountability remain intact across the financial system.

- Banks may request additional documents

- Supports risk management and compliance

- Enhances internal control mechanisms

Operational Impact on Financial Institutions

The revised policy is expected to improve operational efficiency for banks and regulated entities. Faster processing of SBP remittances for non-resident directors will reduce administrative workload and payment delays.

At the same time, the continued emphasis on documentation and due diligence ensures that governance standards are maintained. This balance supports both ease of doing business and regulatory integrity.

- Reduced approval-related delays

- Improved payment efficiency

- Continued regulatory oversight

Summary of SBP Remittance Framework

| Aspect | Details |

|---|---|

| Prior Approval | Not required |

| Eligible Recipients | Non-resident directors and Shariah advisors |

| Currency Basis | Pakistani rupees |

| Bank Responsibility | Due diligence and record-keeping |

FAQs

Who can receive payments under SBP remittances for non-resident directors?

Non-resident directors, chairmen, Shariah advisors, and Shariah scholars serving regulated entities are eligible.

Is prior approval from SBP required for these remittances?

No, banks can process remittances without prior approval once documentation is complete.

What types of payments are allowed under this framework?

Meeting fees, TA/DA, retainers, and other board-approved remuneration are permitted.

What documents must banks retain for compliance?

Banks must keep appointment approvals, remuneration policies, tax proof, and supporting documents.